Social Media for B2B Tech Brands

Where B2B Tech Buyers Really Make Decisions in 2025 - Insights from 100 Decision-Makers

Resonance’s 2025 B2B Tech Buyer Social Survey shows LinkedIn dominates vendor discovery. However, younger buyers and specific industries are on TikTok, Reddit, and private “dark social” channels.

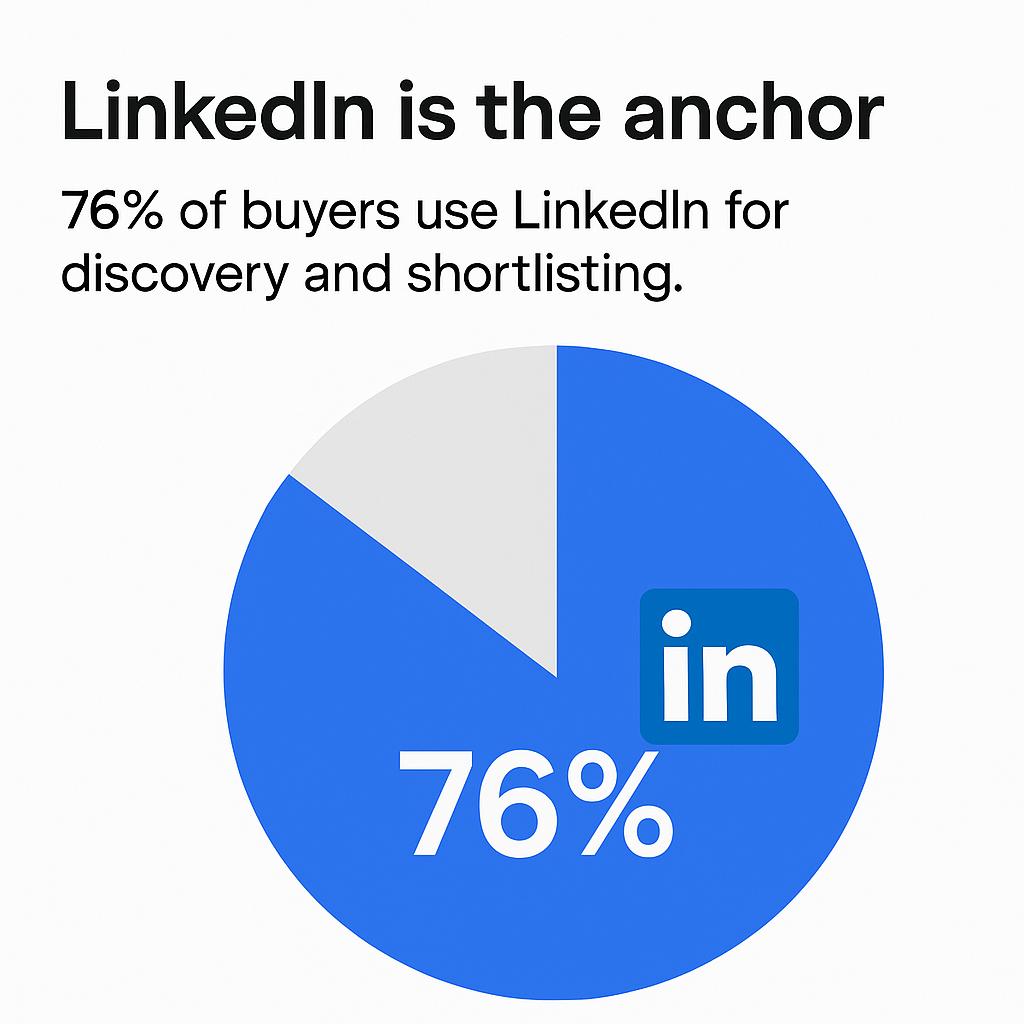

- LinkedIn is the anchor: 76% of buyers use LinkedIn for discovery and shortlisting.

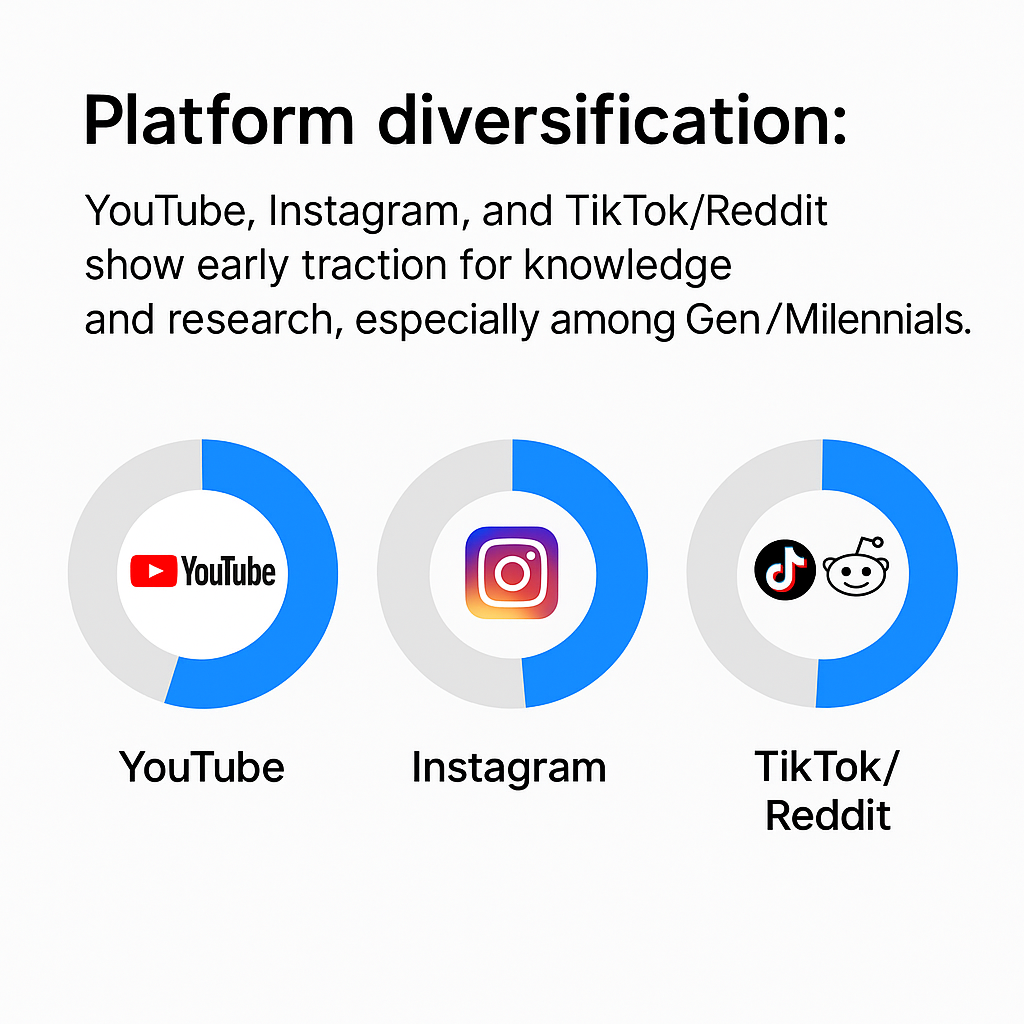

- Platform diversification: YouTube (36%), Instagram (30%), and TikTok/Reddit show early traction for knowledge and research, especially among Gen Z/Millennials.

- Dark social is critical: WhatsApp (47%) and Slack (19%) are key peer-validation channels, particularly in financial services.

- Content preferences are shifting: Short videos, case studies, and live Q&As are today’s top formats and tomorrow’s expected growth areas.

- A trust deficit exists: 44% distrust content that feels too “salesy” and 55% distrust AI-generated content. Independent influencers and employees are rated more credible than CEOs.

- A clear generational split: LinkedIn + YouTube dominate for over-35s; TikTok, Reddit, and WhatsApp are the go-to platforms for under-35 buyers.

LinkedIn Dominates, But the Edges Are Moving In

LinkedIn is still the bedrock for B2B discovery, especially for conservative industries like finance and manufacturing.

With 76% of tech buyers using it for work-related discovery and shortlisting, its position as the primary B2B social channel is undeniable. However, the edges of the market are shifting rapidly. Buyers are consuming content cross-platform.

CMOs can’t rely on LinkedIn alone.

While LinkedIn remains the anchor, YouTube and Instagram are rising as strong second-tier channels. More surprisingly, platforms like TikTok, Reddit, and private WhatsApp groups are demonstrating significant strength among Gen Z and Millennial buyers.

In our research, TikTok was even cited as “most influential” in vendor shortlisting by some of these younger buyers.

That’s a big shift.

This means the entire journey, from discovery through to validation, is now happening in places most B2B tech marketers aren’t even active. LinkedIn must remain core to your strategy, but it must also expand to where the next generation of decision-makers is already forming opinions.

Content is Proof: What Stops the Scroll

The content playbook in B2B tech is shifting.

For years, vendors relied on gated whitepapers, 60-minute webinars, and PDF-heavy marketing. But the data shows that this old formula of “gated whitepaper to landing page to nurture email” doesn't translate to modern social media behaviour. Nobody scrolling LinkedIn or Reddit wants to interrupt their flow to download a PDF.

What content works today

On social, buyers stop for short videos (65%), customer case studies (55%), and live Q&As/webinars (50%).

What content works today?

Infographics (40%) and peer/influencer posts (35%) add credibility and shareability.

What content works today?

Corporate whitepapers (20%) rarely get people to stop, except in Finance, where proof-heavy formats are still valued. Memes do even worse at 15%.

What's expected in the future

Buyers expect more short-form video (70%), peer/influencer content (55%), and podcasts/audio (50%) in their feeds.

Is the whitepaper dead?

Instead of long-form gated content, buyers want snackable proof directly in their feed. They are looking for:

- 60–90 second demos that show how something works.

- Case study snippets with real-world outcomes.

- Direct interaction via live Q&As or webinars.

Why? B2B tech buyers are scrolling social feeds just like consumers, which means the content has to be fast, visual, and trustworthy to earn their attention. B2B tech buying is risky, and decision-makers are making high-stakes calls under pressure. They’re overloaded with content, so they’re filtering for authenticity, speed, and substance. If your content doesn’t deliver clarity in under a minute, it's invisible.

Social is where buyers validate vendors, quickly, publicly, and peer-to-peer. Content that feels human and evidence-led gets shared in dark social channels (WhatsApp, Slack), extending its influence far beyond the brand page. Looking ahead, the appetite for short-form video and peer voices is only growing. Podcasts, too, are carving out a space for long-form but conversational learning.

The Trust Crisis: Who Buyers Believe (and Who They Don’t)

Trust beats polish on social media.

The survey reveals a clear credibility hierarchy, and it's not what traditional marketing models would suggest.

The traditional B2B pyramid (CEO → brand → employee) has flipped. Buyers don’t want canned corporate messaging in their LinkedIn feed, they want voices they can believe.

Survey Insight: Sources of Credibility

- Most credible sources: Analysts, independent influencers, and vendor employees.

- Least credible sources: Executive content and brand-owned channels.

- A major red flag: 44% of buyers distrust content that feels “too salesy” and 55% “AI-generated”.

The hierarchy of trust on social media is clear:

- Analysts, media & Influencers = Authority. Their independent validation is paramount.

- Employees = Authenticity. An engineer explaining a feature in plain English is more trusted than a marketing slick.

- Executives = Mixed. Their content is strong when candid and sharing personal lessons, but weak when it's scripted and staged.

- Brand Channels = Lowest Trust. These are often seen as biased and overly polished.

Chart 3: Bar chart illustrating that analyst voices (62%) and employee content (58%) are the most trusted sources.

This doesn’t mean CEOs or executives should go silent. It means executive thought leadership has to evolve.

A post that reads like a press release fuels distrust. A post that shares personal lessons, founder insights, or even vulnerability performs far better.

Meanwhile, employees and independent experts are already outperforming brand pages.

When an analyst validates your category on X/Twitter, or an employee shares a genuine success story, buyers listen and share.

And remember: social is two-way. Credibility is earned by engaging in conversations, not just broadcasting.

Communities & Dark Social: The Hidden Engine of Influence

The buying journey has shifted behind closed doors. "Dark social", which includes WhatsApp groups, Slack channels, Discord servers, and niche LinkedIn/Reddit communities, has become the hidden layer of influence in B2B tech.

This is where vendors are validated or dismissed, far from the watchful eyes of marketing dashboards.

Survey Insights: The Power of Private Channels

- Active Channels: WhatsApp groups (47%), Slack (19%), and Discord (14%) are active channels for sharing vendor information.

- Powerful Validators: 40% of buyers rated communities as “very important” for vendor perception.

- Private Sharing: Buyers often share vendor content privately, beyond the visibility of brand dashboards.

Different industries use different channels. Finance buyers validate through WhatsApp and Slack. Tech/software audiences are experimenting with Reddit and Discord. Manufacturing remains more conservative, leaning on LinkedIn groups. For marketers, this poses a problem: you can’t pixel-track WhatsApp. You can’t retarget a Discord DM. But ignoring it is reckless.

Solution: Making Dark Social Work for You

Dark social may be invisible to dashboards, but it’s not beyond strategy. CROs and CMOs can desgn for shareability and create community-first touchpoints.

- Design Shareable Proof: Create snackable assets (30–60 second demo clips, stat cards, testimonial carousels) optimized for WhatsApp or Slack forwarding. Equip sales teams with “ready-to-share” content packs.

- Seed Influence in Communities: Run Reddit AMAs ("Ask Me Anything") or participate in relevant threads with subject matter experts. Offer tailored insights or toolkits that community moderators are happy to distribute.

- Leverage Employee Advocates: Employees are already in these groups. Train and empower them with micro-content and trust guidelines so they become credible voices in conversations that brands can't officially enter.

- Evolve Attribution: Use survey-driven attribution (“Where did you first hear about us?”) alongside tech tools. Track secondary signals like spikes in direct traffic or brand search, which often reflect dark social momentum.

The Generational Divide: The Next Buyer is Already Here

The future has already arrived. Millennials are in senior buying roles; Gen Z is entering procurement committees. Their media diets don’t resemble their predecessors'.

They expect short-form, visual, authentic content. They don’t separate “B2C” and “B2B”. They expect the same speed, personality, and proof in both.

- Under-35 buyers: Lean into TikTok, Reddit, and WhatsApp for discovery and even shortlisting.

- Over-35 buyers: Still prioritize LinkedIn (80%) and YouTube (40%).

- LinkedIn's User Base: It's worth noting that 62% of LinkedIn’s user base is under 35 (external benchmark), meaning the platform itself is becoming younger.

If your social presence still looks like a corporate brochure, you won’t even make it into the feed of these younger buyers. Meanwhile, older buyers still rely on traditional LinkedIn thought leadership and YouTube explainer videos, creating a dual-track content demand.

Implications for Your Strategy:

- A/B test content formats by generation. Serve formal thought leadership for Gen X/Boomers, and snackable reels and carousels for Millennials/Gen Z.

- Prioritize platform splits. Focus on LinkedIn + YouTube for the 35+ demographic, while piloting on TikTok/Reddit for the under-35s.

- Arm your teams with the right content. Whitepapers won’t work in WhatsApp; 30-second demo reels will.

- Future-proof your enablement now. The youngest buyers are already shaping vendor shortlists.

Looking Ahead: The Role of Social is Only Growing

We are at an inflection point.

For years, B2B marketers treated social media as a top-of-funnel awareness play. The “serious stuff” happened in analyst reports, whitepapers, and RFP meetings. That's changing, and fast.

- Today: Tech buyers rate social media's importance in vendor decisions at around 3 out of 5. It’s not fluffy, and it's not optional.

- Tomorrow: A majority expect its role to grow significantly in the next two years.

- Generational Divide: Under-35 buyers are the most bullish, expecting social to become a central decision-making channel.

In just two years, the same CIO who still clings to LinkedIn today may treat a WhatsApp group recommendation or a TikTok explainer video as seriously as a Gartner Magic Quadrant.

Why? Because buyers want fast, peer-validated, authentic signals. And they’ll find them wherever the conversation happens.

Our survey shows buyers are already shortlisting vendors via TikTok, validating with peers in WhatsApp, and relying more on influencers and employees than on brand channels.

What looks like “fringe behaviour” now will be mainstream buyer behaviour tomorrow.

Implications for CROs & CMOs

- Invest now, don't wait. LinkedIn is still the cornerstone, but forward-thinking brands must pilot on YouTube, Instagram, TikTok, Reddit, and private communities.

- Future-proof attribution. Pipeline models must account for influence in “invisible” channels. If a deal closes after six months of WhatsApp group chatter, that's still a marketing success.

- Reframe social’s role. It’s not a “nice-to-have awareness lever.” It’s the arena where vendor trust is won or lost.

Bottom line: Those who build credibility early on the edges of social (TikTok, WhatsApp, Reddit) will be tomorrow’s category leaders.

Conclusion: No Longer Boring-to-Boring

The 2025 Resonance survey shows one thing clearly: B2B social media is no longer Boring-to-Boring. It’s dynamic, multi-platform, peer-driven, and powered by authenticity.

- Buyers want short-form video over PDFs.

- They trust influencers, peers, and employees over brand execs.

- They share and validate in dark social spaces that brands can't pixel-track.

- And they expect social’s role in buying to grow significantly in the next 24 months.

The future of B2B tech buying isn’t happening in gated PDFs. It’s happening in feeds, groups, and DMs.

The question is: will your brand be part of the conversation, or the one being left out of it?

WHAT OUR CLIENTS SAY

.png?width=269&height=269&name=Untitled%20(37).png)

“The quality of the relationships Resonance have with different journalists, coupled with the quality of their thinking and output is great. Plus, they are flexible, open to ideas, deliver on time and provide great comms. You feel they are an extension of your own team.”

Lexi Fox-Mills

Associate Director - Content Marketing, Moody’s KYC

"The intricacies of the data-driven landscape is written into the DNA of Resonance. We are built for the data economy."

"The intricacies of the data-driven landscape is written into the DNA of Resonance. We are built for the data economy.".jpeg?width=250&height=181&name=AdobeStock_565367297%20(1).jpeg)

"In Tech PR we have a front row seat to the changing technology landscape. From Generative AI to Quantum, it's our job to insert our clients' voices into the narrative"

"In Tech PR we have a front row seat to the changing technology landscape. From Generative AI to Quantum, it's our job to insert our clients' voices into the narrative"

"In a world where the only constant is change, how do tech brands stay one step ahead of the market? That's where Resonance comes in"

"In a world where the only constant is change, how do tech brands stay one step ahead of the market? That's where Resonance comes in".png?width=219&height=219&name=Seb%20Moss%20wavelength%20thumbnail%20(1).png)